- Real Estate Investors Newsletter

- Posts

- Bonus Depreciation - Are you making the most of your property?

Bonus Depreciation - Are you making the most of your property?

Hey there!

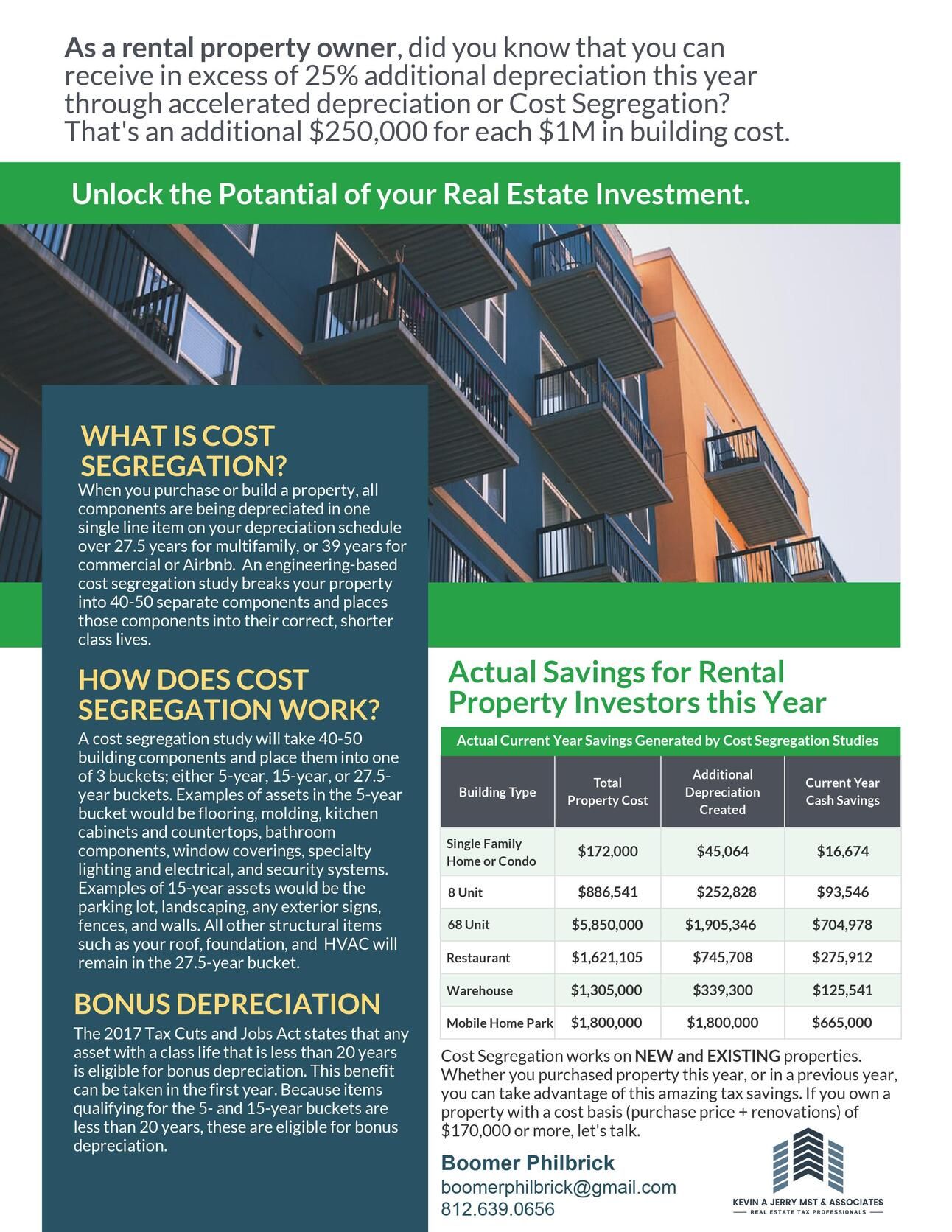

I've got some exciting news for you - there's a legal loophole that most investors don't know about, and it could greatly reduce or even completely eliminate your income taxes this year. It's called cost segregation, or accelerated depreciation.

Cost segregation allows you to depreciate property over a faster schedule, which increases your annual depreciation, reduces your income, lowers your tax liability, and ultimately boosts your CASH FLOW.

Normally, when you purchase a property, everything is depreciated as a single line item over 27.5 years for multifamily or 39 years for commercial or Airbnb. Cost segregation breaks your property into 40-50 components and places them into shorter class lives that align with their actual, useful life. After all, carpeting won't last 27.5 years!

Your goal as an investor is to shorten the life of as many assets as possible. Thanks to Trump's 2017 Tax Cuts and Jobs Act, we have 100% bonus depreciation for assets in 5 and 15 year property. This means they can be fully depreciated immediately in the present year, resulting in big savings for you right away.

The beauty of cost seg is that it works on both NEW and EXISTING properties.

I've partnered with the top cost segregation firm in the country. They've already saved investors millions in 2024, and now they're ready to help you.

Check out the attachment to see if you could benefit from these CASH savings. Imagine what you could do with your tax savings - pay off debt, buy more properties, retire early? The possibilities are endless!

To your success,

Julian

P.S. Your bank account will thank you for taking the first step. Reach out to Boomer Philbrick 812.639.0656 [email protected]

And tell him you’re from the Real Estate Investors Newsletter to see how much you could save.